.png?width=768&name=Untitled%20(1280%20%C3%97%20300%20px).png)

What does this mean for its former and current employees?

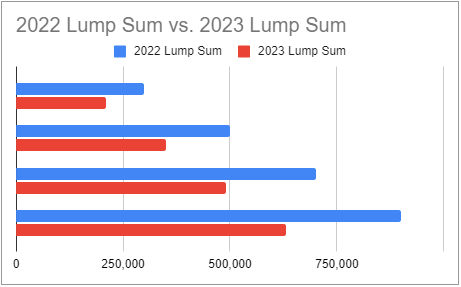

As interest rates go up, lump sum pension payments go down. These higher rates allow AT&T to

reduce its pension payouts for future retirees by up to 30%, according to an AT&T employee

memo. Future AT&T retirees may have less capital to meet their retirement goals. Please talk

with a financial advisor to see how you can mitigate its effect on your financial future.

"Retiring just a few days apart can make a $300,000 difference."

before the reductions in pension benefits. Typical plan participants who retire with 30 years of

employment can lose upwards of hundreds of thousands in their payout. Retiring just a few days

apart can make a $300,000 difference.

Your Comments :