Longevity is here to stay.

But it’s quality – not just quantity – of life that truly matters.

Fortunately, we’re here to help you with both.

According to the World Health Organization, global average life expectancy has risen by more than six years in the past two decades. That’s why it’s more important than ever to have a plan for your finances, your health, your legacy and beyond – so that you not only live longer, but live better.

PICTURE YOUR PLAN

The idea that only those with chronic conditions – about 50% of U.S. adults – or the elderly need proper longevity planning is a misguided one. In fact, because healthier individuals are more likely to live longer, they need to prioritize a longevity plan that will allow them to fund

even more retirement years.

The key is to think of longevity planning as part of your larger financial picture and then incorporate it into your current financial plan. To do so, it’s crucial to examine your income sources versus your costs during retirement as well as determine how preplanning can serve to mediate unexpected expenses.

This may sound like a daunting task, but in addition to our advisory experience, we leverage an innovative, interactive wealth planning tool that enables you to explore a wide range of potential scenarios and solutions – from estate planning to long-term care and healthcare options. This software offers a center point from which to create the future you envision. Furthermore, you’ll be able to draw from our team’s longevity planning expertise and our understanding of your unique circumstances to ensure your plan is exactly what you want.

PRESERVING THE FRUITS OF YOUR LABOR

Longevity planning isn’t just about investment management – it’s also about protecting your hard work. This is particularly crucial when you consider that, according to the Insurance Information Institute, investors lose hundreds of millions of dollars in fraud each year. We recognize the importance of safeguarding your savings.

That’s why we partnered with a technology service that protects families against financial abuse and identity theft by:

• Applying proprietary algorithms designed by specialists in aging, fraud, identity theft, financial services and law enforcement to analyze financial accounts, credit cards and credit report data for suspicious activity

• Supporting the designation of trusted advocates (usually loved ones eligible to receive suspicious activity alerts on your behalf) to reinforce monitoring

• Providing personalized referrals and expert remediation assistance in cases where fraud is detected

FAMILY DYNAMICS

After you make a plan, let your family know what decisions you’ve made and what your expectations are. While the conversations you’ll have can be challenging, establishing a family meeting can leave everyone feeling more confident about the future.

Safeguarding your savings

Are you protecting yourself and your assets from identity theft and fraud?

Consider these questions to find out:

Do I have a centralized location that allows me to view all of my accounts and monitor unexpected changes?

It’s a good idea to check your accounts frequently for signs of fraud. You can also rely on resources that automatically track your spending habits and alert you of suspicious activity. Aside from mitigating identity theft attacks, these resources search the dark web for your information to further protect your privacy.

If need be, can I monitor my loved ones’ accounts?

You may need to monitor accounts besides your own, such as those belonging to older loved ones. You may also need to assist your young adult children in understanding, and planning for, financial independence.

Are my parents vulnerable to scams?

Isolation increases the risk of fraud. Fortunately, we can help you protect your loved ones from falling victim to an attack while preserving their independence by helping you keep an extra eye on their finances in one simple place.

MAKING THE MOST OF LIFE’S MILESTONES

Our lives are often defined by remarkable milestones. The birth of a child, for instance, could inspire you to

have valuable family conversations as well as drive you to reevaluate your financial and legacy plans.

New milestones or changes in your or your family’s circumstances offer an ideal opportunity to contemplate the values you hope to instill in future generations; the lessons you hope to teach them; and the legacy you wish to leave behind. It’s in that spirit that we offer a step-by-step tool to help you clearly address legal, financial, healthcare and personal decisions.

Our offering allows you to create a complete, organized and shareable plan for your family and trusted advocates – covering everything from investments, insurance and even the deed of your home to family photos and favorite recipes. This helps give your family peace of mind through proper legacy planning, and gives you the opportunity to tackle this difficult topic in advance and in a safe space, ensuring that your legacy lives on beyond your years.

NAVIGATING TWISTS, TURNS AND DETOURS

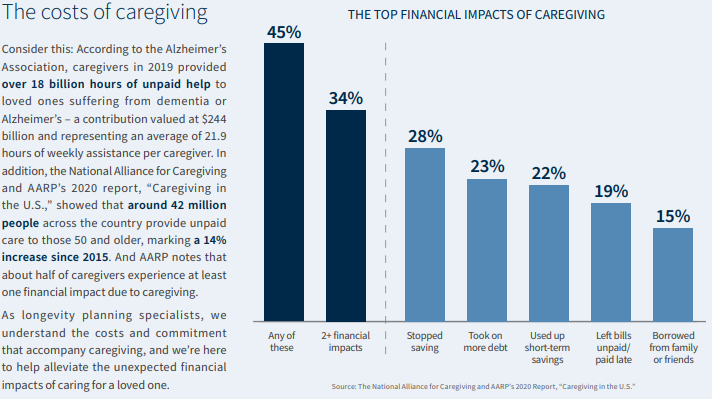

Along with milestones, life’s journey is also defined by its detours, such as suddenly becoming a loved one’s caregiver.

It’s crucial to recognize that caregiving takes many shapes. You can be a hands-on helper, guiding a loved one through daily tasks such as dressing and bathing, or instead offer care by scheduling doctor appointments and helping your loved one attend these visits. You might be a financial caregiver providing monetary support, or offer emotional support simply through your company. You might even find yourself serving as caregiver from afar, offering assistance without living in the same city as your loved one.

Despite the ups and downs of caregiving, there is one constant: it requires you to put someone else’s needs above your own. This can make it difficult for caregivers to prioritize themselves and admit when they need to ask for support.

You can count on us to help you address the complexities of caregiving and determine the best way to offer the support your loved one needs. This can include reexamining your wealth-building plan to determine how much of a financial helping hand you can extend and how much time you can afford away from work, as well as connecting you with resources to help navigate the many intricacies of caregiving and healthcare.

ADVOCACY YOU CAN TRUST

In addition to our team’s guidance, we offer a range of advocacy solutions designed to support a higher quality of life. To help you successfully address the many challenges involved in caring for aging or disabled loved ones, we can connect you with experts to take on responsibilities such as interviewing and screening in-home caregivers, hiring contractors for home modifications, attending and coordinating medical visits, planning outings, visiting clients to celebrate special occasions and more. They can even help you choose the best nursing home or extended care facility for your loved one.

Our suite of longevity solutions focused on caregiving also includes access to healthcare advocates who can:

• Coordinate with your health insurance companies to ensure the best possible coverage

• Help you answer fundamental questions, such as: Is my diagnosis correct? Is surgery necessary for my condition or is there an alternative option? Which facilities have been shown to offer the best outcomes?

• Collaborate with dedicated health advisors, who are supported by M.D. and Ph.D. physicians and researchers, to walk you through different medical diagnoses – taking on everything from reviewing medical charts to recommending appropriate doctors and specialists

No matter the detours or milestones along life’s path, you can count on us to guide you along the way.

CONNECTING THROUGH THE YEARS

It’s no secret that meaningful relationships with family and friends enrich our lives. But here’s what you might not know: Social connections can improve your immune system, lower risks of heart problems and high blood pressure, lead to fewer incidences of cancer, and deter osteoporosis and rheumatoid arthritis, according to research from the Yale Medical Group. Keeping in mind these far-reaching benefits, it’s of essence to incorporate socialization – such as having access to organizations and activities outside your home – into your longevity plan.

EMBRACING AN ENCORE CAREER

Living out your purpose might include an encore career, known as a second vocation beginning in the latter half of

one’s life that typically prioritizes personal fulfillment. You might instead decide to invest in your values by serving as a volunteer for causes near and dear to you. No matter how you choose to realize your life’s passion, you can count on

us to support you each step of the way.

PLAN FOR YOUR CARE

Caregiving doesn’t just mean planning for your loved ones’ care. It also includes planning for your own. For instance, do you want to age in your current home or would you prefer to move? Is limited mobility a growing concern for you? Have you considered the different costs associated with aging in place? These and other questions can help shape your longevity plan and offer a clearer view of what your future might entail.

MAINTAINING INDEPENDENCE BY AGING IN PLACE

The decision to remain in the home and community of your choice as you age is known as aging in place. Despite this being an empowering option that can allow you and your loved ones to maintain independence, Barron’s reports that only 1% of U.S. homes meet the five basic universal design criteria recommended for those aging in place, such as no-step entries and levers instead of doorknobs.

MAXIMIZING MEDICARE

To help you select the best Medicare plan for your needs,

we can connect you with licensed agents across the nation

who can provide unbiased, discerning guidance on the best

Medicare options for your distinct needs.

It’s important to take the time now to explore your potential aging-in-place needs and determine how you and your loved ones will financially, emotionally and physically prepare. You’ll want to take into account everything from transportation and meal preparation to medication and home management. You can also consider alternative options, such as relocating or moving in with a family member. Regardless of what you decide, you won’t have to go it alone. We can help facilitate these conversations with your family or friends, build the costs into your financial plan and prioritize your peace of mind as you consider aging in place

Heeding Healthcare costs

Healthcare costs are likely to continue climbing at a rate of up to 2.5 times that of U.S. inflation. As a result, a couple who starts receiving Social Security payments at age 65 will have healthcare expenses consume nearly 70% of their benefits.* That’s why it’s imperative to think long term by making consistent contributions to your retirement nest egg and establishing the right long-term care and insurance policies well in advance. We can help evaluate your current situation to determine what you’ll need to meet those goals.

*HealthView Services, “2021 Retirement Healthcare Costs Data

Report”

Your future is too important to leave up to chance. Together, we can create a longevity plan that’ll help you confidently step into the tomorrow you envision.

Your Comments :