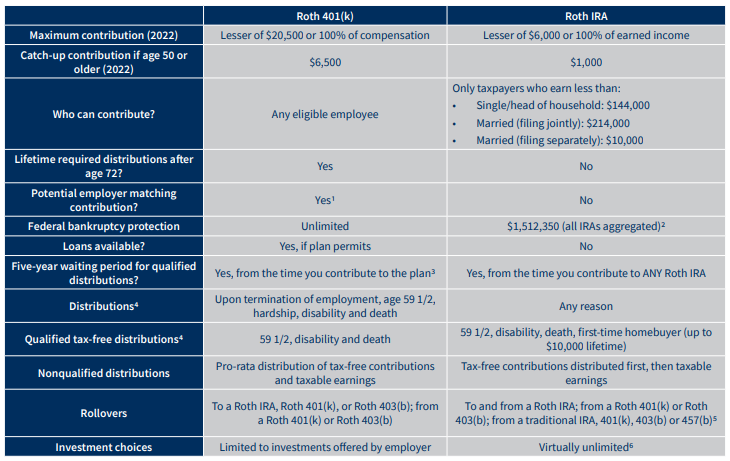

1. Employer contributions and earnings are taxable when distributed.

2. SEP/SIMPLE IRAs and amounts rolled over to an IRA from an employer qualified plan or 403(b) plan, plus any earnings on the rollover, aren’t subject to this dollar cap and are fully protected under federal law if you declare bankruptcy.

3. Or from the time you contributed to a previous employer’s Roth 401(k) plan, if you rolled over your balance from that plan to the current plan.

4. Depending on plan terms. Taxes and potential penalties apply to earnings paid in a nonqualified distribution.

5. Taxable conversion.

6. Choices will depend on IRA trustee/custodian.

A plan participant leaving an employer typically has four options

(and may engage in a combination of these options):

• Leave the money in their former employer’s plan, if permitted;

• Roll over the assets to their new employer’s plan, if one is available and rollovers are permitted;

• Roll over to an IRA; or

• Cash out the account value.

Qualified plans and IRAs typically involve investment-related expenses and plan or account fees. Investment-related expenses may include sales loads, commissions, the expenses of any mutual funds in which assets are invested, and investment advisory fees. Plan fees typically include administrative fees (e.g., record-keeping, compliance, trustee fees) and fees for services such as access to a customer service representative. In some cases, employers pay for some or all of the plan’s administrative expenses. An IRA’s account fees may include administrative, account setup and custodial fees.

Your Comments :